KEY HIGHLIGHTS

- Several Australian banks lifted term deposit rates again this week

- Some long-term rates now sit well above what most savers expected in 2026

- Top returns hit 4.70% p.a., but conditions matter

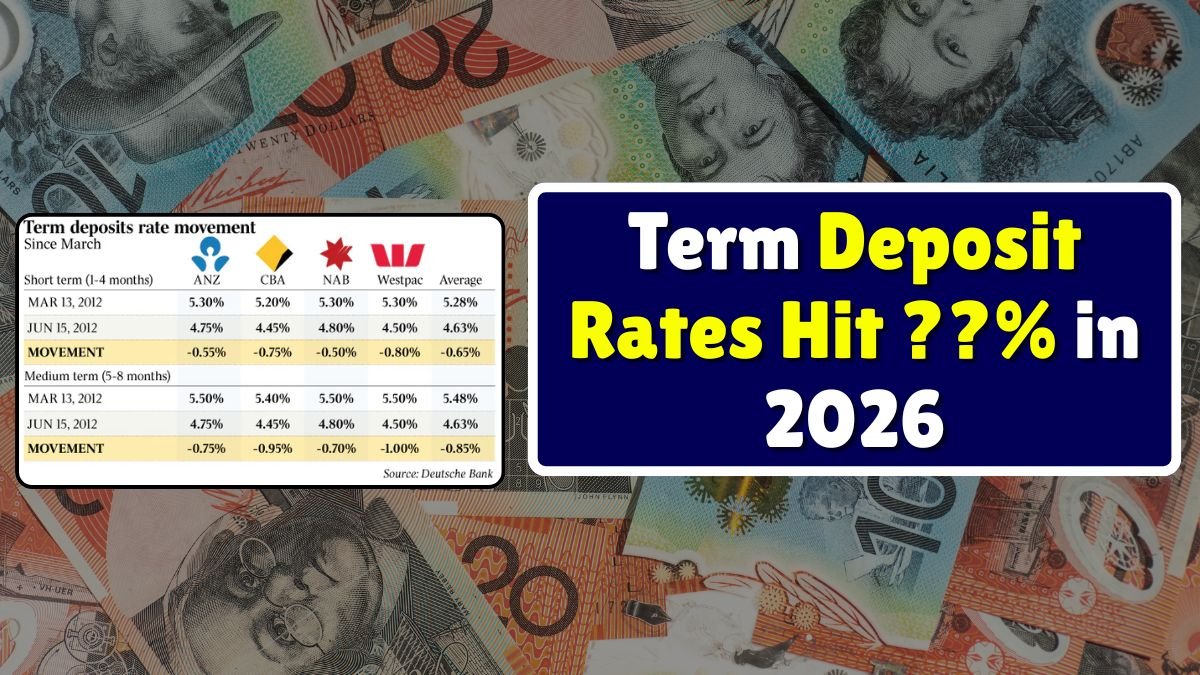

Over the past week, multiple banks pushed rates higher, with a few smashing previous “best on market” levels tracked by Savings.com.au. This comes as expectations grow that the RBA may be done with rate cuts for now — or at least won’t rush into them anytime soon.

What’s interesting is where the strongest moves came from. While big names like ANZ and Suncorp did lift rates, it was smaller and specialist banks that really stole the spotlight, especially for savers willing to lock money away for longer.

| Bank | Term | Rate (p.a.) | Minimum Deposit | Notes |

|---|---|---|---|---|

| Rabobank | 5 years | 4.70% | A$500,000 | Highest long-term rate |

| Heartland Bank | 1 year | 4.50% | A$10,000 | Market-leading short terms |

| G&C Mutual / Unity | 1 year | 4.50% | Varies | Strong mid-term option |

| Suncorp | 1 year | 4.35% | A$5,000 | Best among top-10 banks |

| ING | 9 months | 4.30% | A$10,000 | Competitive flexibility |

Rabobank goes big on long-term rates

The standout move of the week came from Rabobank, which lifted parts of its term deposit range by up to 50 basis points.

Its five-year term deposit now pays 4.70% p.a., the highest rate currently listed in the Savings.com.au database. There is a catch though — you’ll need at least A$500,000 to qualify. Deposits between A$100,000 and A$500,000 earn 4.60% p.a., while smaller balances above A$1,000 still get a solid 4.50% p.a.

Rabobank’s three- and four-year terms also moved higher and now lead the market for those durations. For long-term savers who don’t need quick access to cash, this is about as strong as it gets right now.

G&C Mutual and Unity Bank hit 4.50% for one year

The newly merged G&C Mutual Bank and Unity Bank also made a timely move.

Both brands lifted nine-month and one-year term deposit rates. The nine-month rate jumped 20 bps to 4.45% p.a., while the one-year term now sits at 4.50% p.a.

For a brief moment, that one-year rate was the outright best on the market — until another bank responded almost immediately.

Heartland Bank stays near the top

Heartland Bank nudged its rates higher by 5 basis points, which was just enough to stay right in the mix.

- Six months: 4.45% p.a.

- Nine months: 4.47% p.a.

- One year: 4.50% p.a.

All rates apply to deposits of A$10,000+, paid at the end of term.

Heartland now holds the top six- and nine-month rates, and sits level with G&C Mutual and Unity Bank for the best one-year return. If flexibility matters more than locking away cash for years, this is worth a close look.

ANZ lifts rates — but still trails smaller players

ANZ was the biggest name to move rates this week, lifting some terms by up to 20 bps.

Despite the increase, most ANZ term deposits still sit below 4.00% p.a., with the exception of its eight-month term at 4.25% p.a., which remains the highest among the big four banks.

For savers who prefer household-name banks, it’s an improvement — just not market-leading.

Suncorp edges ahead of other major banks

Suncorp quietly pushed its rates higher by up to 10 bps, and the result is impressive by big-bank standards.

Its one-year and 18-month term deposits now pay 4.35% p.a., making Suncorp the highest-paying bank among Australia’s top 10 for those terms. It now beats competitors like ING and Macquarie on headline rates.

ING, Great Southern and other movers

ING adjusted rates across several terms, now offering 4.30% p.a. for six, nine and twelve months. The nine-month term stands out as particularly competitive.

Great Southern Bank made one of the widest sets of changes, with rate movements of up to 70 bps. Its Platinum Plus products for customers aged 55 and over now pay up to 4.30% p.a. for two years.

Other banks that moved rates include Judo Bank, RACQ Bank, Newcastle Permanent, and Gateway Bank — with new rates clustering between 4.25% and 4.45% p.a.

What this means for Australian savers

For most Aussies, the big takeaway is simple: term deposits are competitive again.

You don’t need to chase risky investments to get returns above 4.00% p.a., but you do need to shop around — and be realistic about how long you’re happy to lock your money away.

Short-term flexibility? Heartland and ING look solid.

Long-term certainty? Rabobank is hard to ignore.

Prefer a major brand? Suncorp is leading the pack.

Frequently Asked Questions

Are term deposit rates still going up in Australia?

Right now, yes — but increases are becoming more selective. Some banks are pushing hard, while others are holding steady.

Is locking money away for five years worth it?

Only if you’re confident you won’t need access. Rates like 4.70% p.a. are attractive, but flexibility is the trade-off.

Are these rates guaranteed?

Yes. Term deposits are fixed for the agreed term, provided you don’t withdraw early and meet the conditions.